For example, you’ll want to consider if there are any monthly fees, overdraft fees and ATM fees that might apply when using a non-Chase ATM, minimum deposit requirements and more.

Like all banking options, there are pros and cons that may make more or less of a difference depending on your situation, needs and so on. Pros and Cons of Chase College Checking Accounts When you open your account, you will be given an account number information, a visa debit card and a pin number. If you’re unsure whether the documents you have can be used as proof of identification or student status, contact your local Chase branch and ask for clarification. students still need to supply a residential address (U.S. student, you can still open a Chase College Checking account in any Chase branch as long as you have a passport with photo and the Student INS I-20 or ICE I-20 form or DS-2019 form. Something like a transcript or an acceptance letter works. You’ll also need proof of your college/university student status and expected graduation date.

SHOULD I CHANGE MY CHECKBOOK AFTER A MOVE PNC BANK LICENSE

To open a new account at a Chase branch location, you will need to bring two forms of ID, such as a Social Security card, taxpayer identification number (TIN), driver’s license with photo or a student ID with photo.Account opening online requires your Social Security number, a driver’s license or state-issued ID, and your contact information.The basic eligibility requirements for a Chase College Checking account are as follows: (Note that if you are still in high school, you can instead opt for a Chase High School Checking account, which you can convert to a college checking account once you matriculate.) Eligibility Requirements for Chase College Checking AccountsĬhase College Checking is for college students who are 17 to 24 years old. In this article, we cover six things you need to know if you’re considering opening a student checking account through Chase bank. The Chase College Checking account is just one example. Since college students often have very different financial habits and concerns than adults who have entered the workforce, many banks offer checking accounts designed for college students. If you decide you’d still like some cash in your pocket, it’s easy to withdraw money from your account at any time with an ATM machine or by getting cash back during purchases.

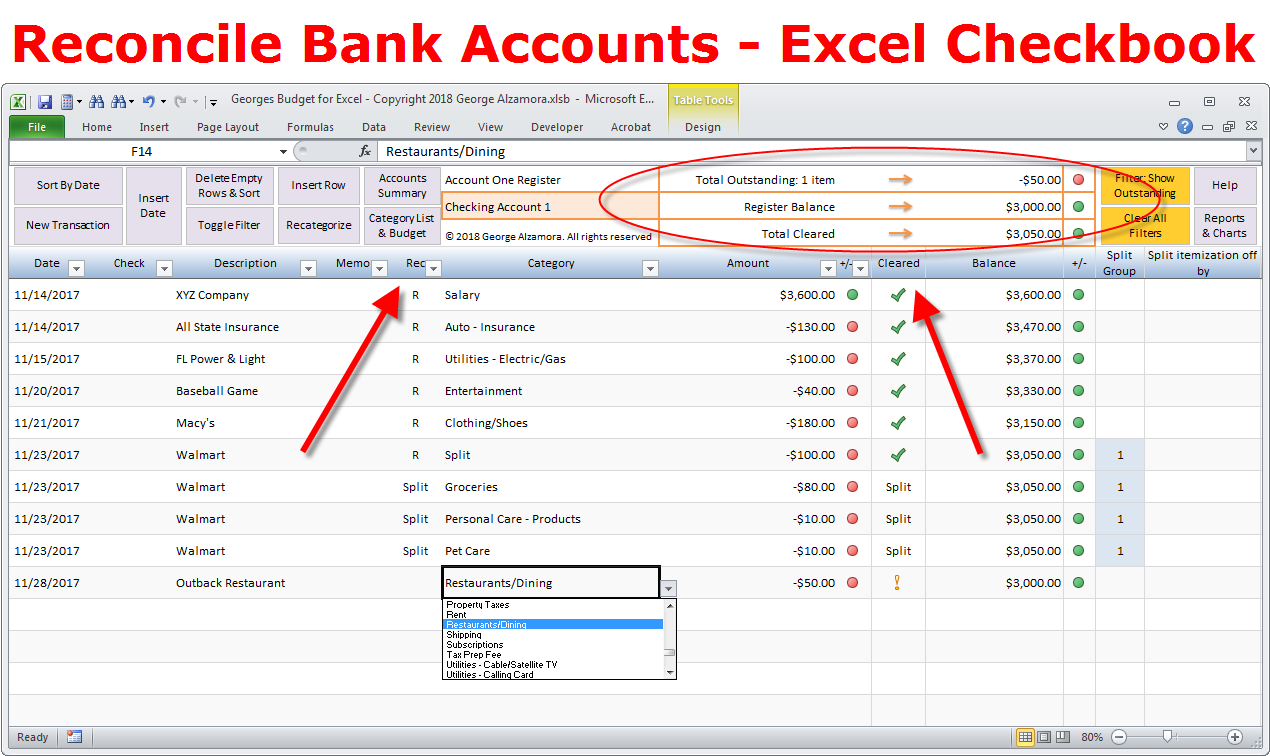

Having a checking account also makes it easier to track your spending since you can view your account balance and all of your transactions and debit card purchases online or on your monthly statement. It’s also safer to carry around a debit card instead of cash - if the former gets stolen, you can immediately shut down the card to prevent further losses. Checking accounts make it easy to handle your personal finances, including check deposits, bill payments and making online purchases. Whether you’re just starting college or have been hitting the books for a few years, if you don’t have a checking account, it’s a good idea to set one up.

0 kommentar(er)

0 kommentar(er)